THE S3 ESSENTIAL FOUNDATION INVESTMENT PORTFOLIO

(AN EXAMPLE HYPOTHETICAL PORTFOLIO)

Watch this video to learn the recipe for TEFIP (The Essential Foundation Investment Portfolio)

If you would like to learn about investing and learning how to build a similar portfolio for yourself, please write to us.

THIS IS NOT AN ACTUAL, BUT A HYPOTHETICAL EXAMPLE OF A PORTFOLIO.

Overview

Why S3 Essential Investment Portfolio

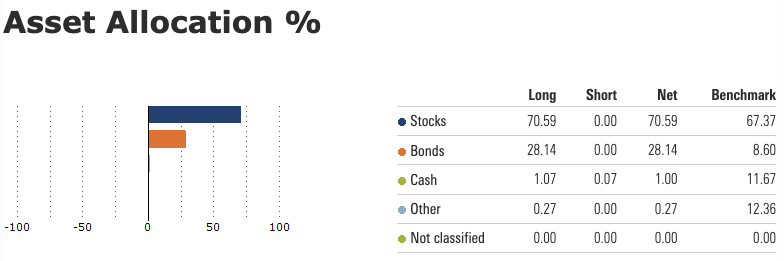

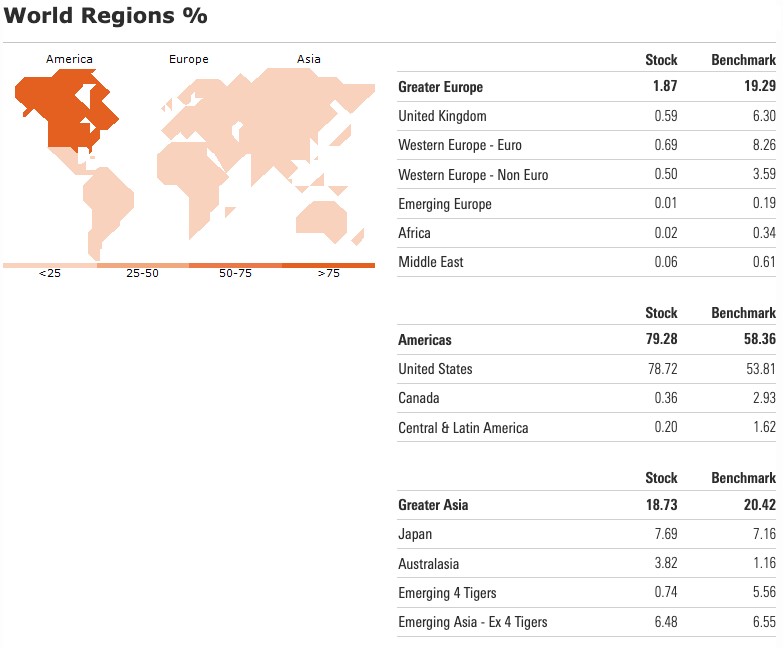

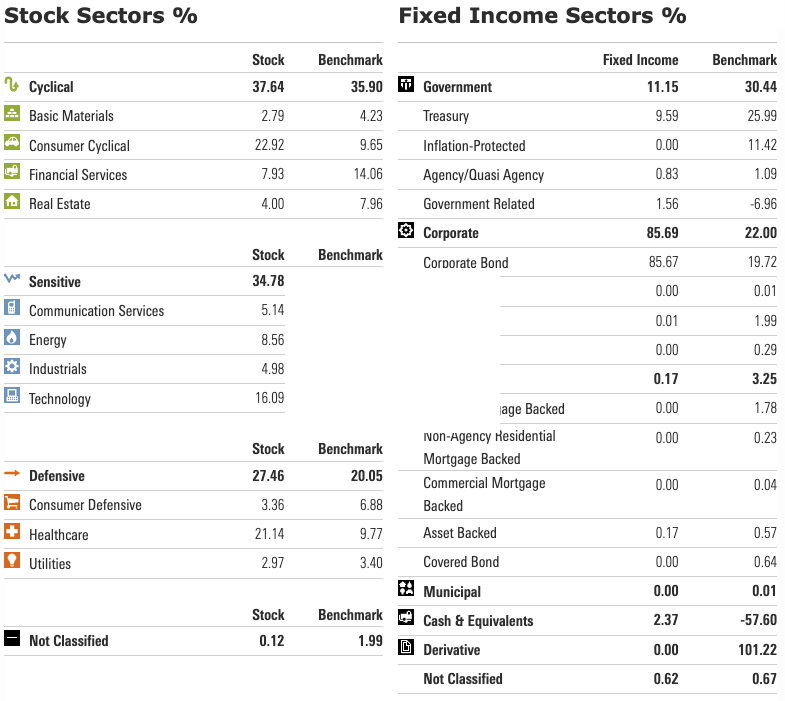

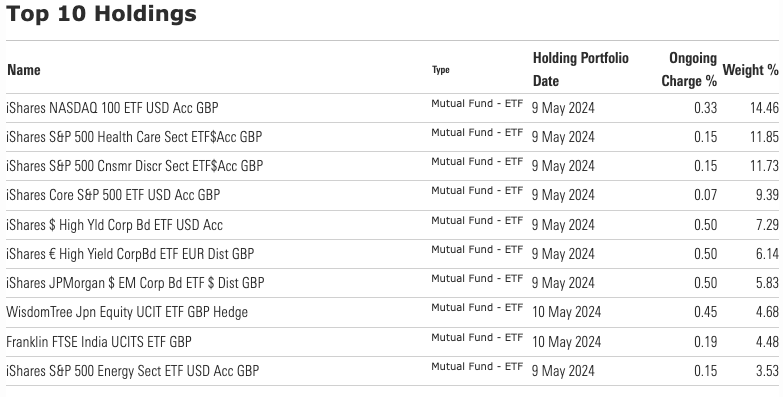

- A simple and efficient way to gain exposure to a portfolio of foundation ETFs that is diversified by asset class, sectors and industries, and across regions and countries, in one essential package.

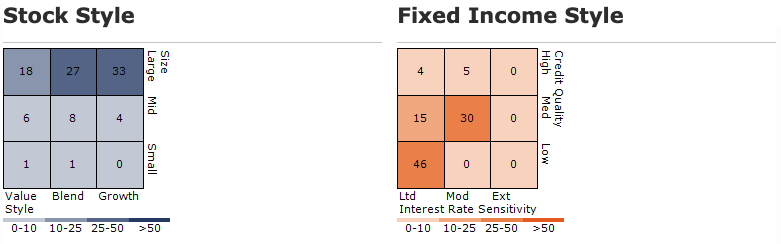

- Focused on growth through selective focus on equities, fast-moving and innovative sectors, high-yield bonds, private equity, and growing and stable markets and economies.

- Integrated into one’s lifestyle and cashflow by providing dividend and coupon income through bonds for diversification, risk and volatility reduction and capital preservation.

- Incorporates low-cost passive index based ETFs mostly, yet managed actively to align the portfolio to investment objectives.

Investment Objective

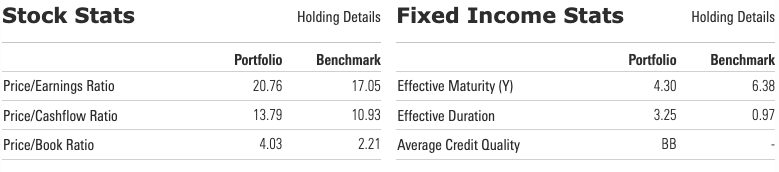

The portfolio seeks to provide long-term capital growth and income by investing primarily in one or more exchange-traded funds comprising technology, health care, and consumer discretionary sectors for growth and energy, utility, private equity including BDCs, REITs (real estate) along with high yield corporate and government bonds for dividend and coupon income performance.

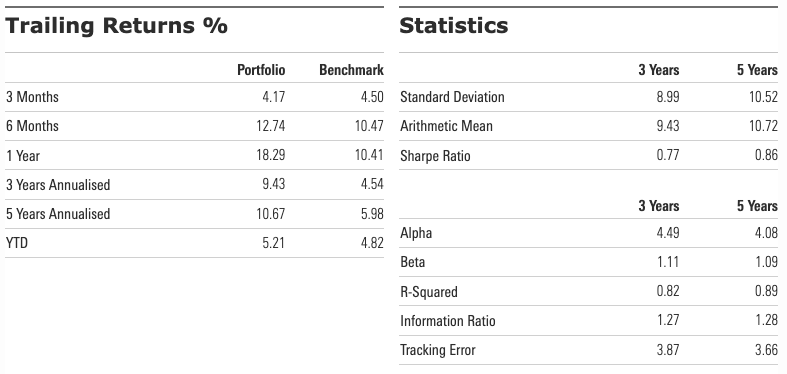

Performance

As of May 10, 2024

Trailing Returns (%)

1 yr

18.29

3 yr

9.43

5 yr

10.67

YTD

5.21

Growth of hypothetical GBP 10,000

S3 Essential Investment Portfolio

Morningstar USD Aggressive Allocation Index

Asset Allocation

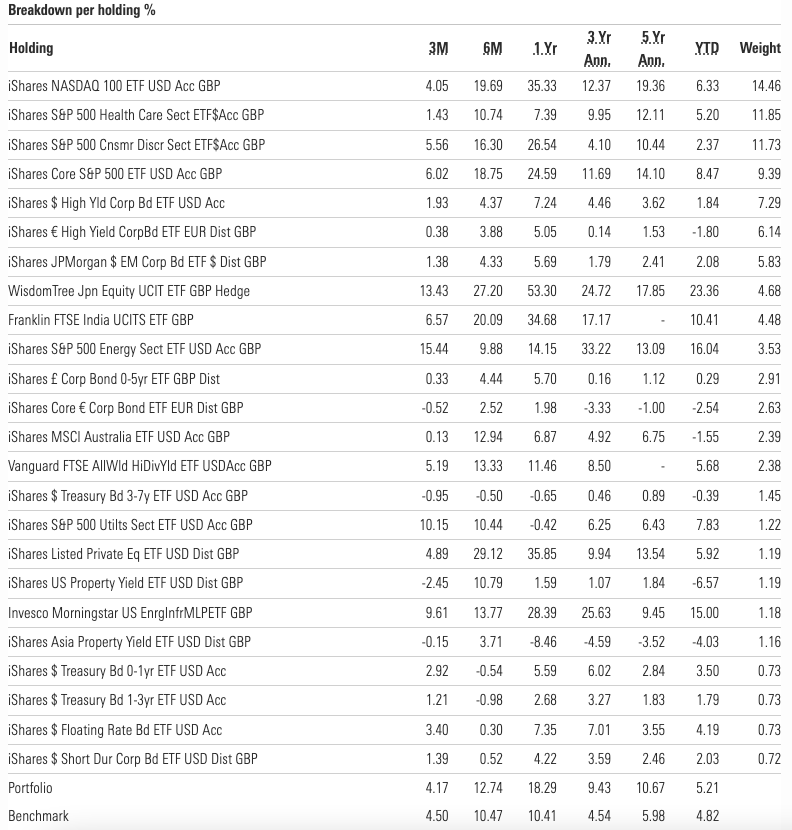

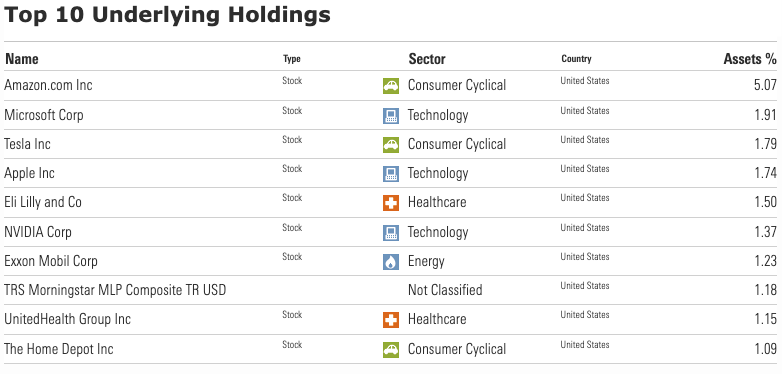

Holdings Breakdown

THE ABOVE IS NOT AN ACTUAL, BUT A HYPOTHETICAL EXAMPLE OF A PORTFOLIO.